Alerts and Budgeting

Managing Alerts and Reminders at Bay Federal Credit Union

At Bay Federal Credit Union, we make it easy to stay informed about your finances with customizable alerts and reminders. Whether you need to be reminded when a loan payment is due, notified when a deposit is received, or want to track account activity, our system offers flexible options to keep you updated. This FAQ section will walk you through setting up alerts for payments, transactions, and other key account activities, ensuring you're always in control. If you have any questions, our support team is available by phone or chat for further assistance.

Alerts & Budgeting FAQ

You have access to alerts in BayFedOnline and the BayFed Mobile app that can send you an email, text message, or mobile device notification.

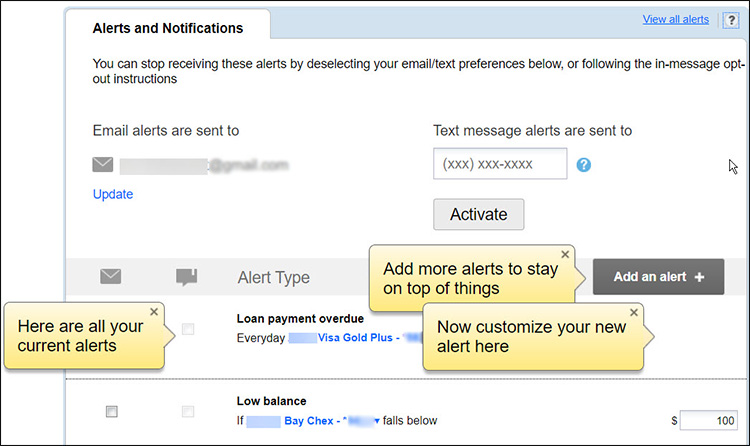

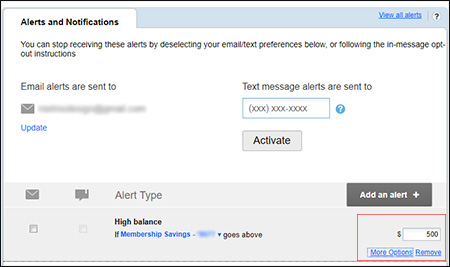

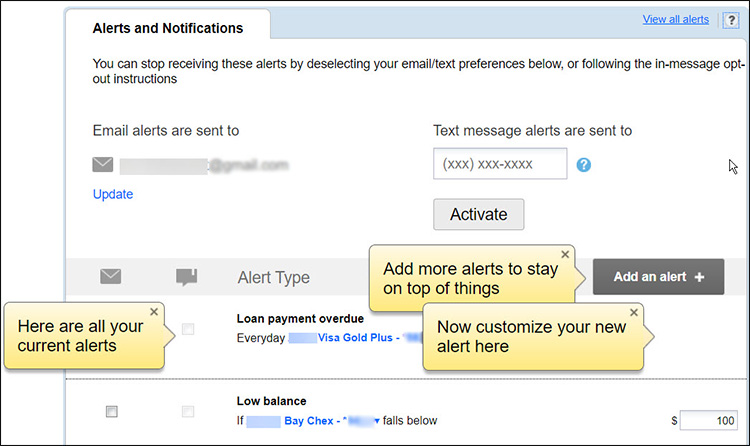

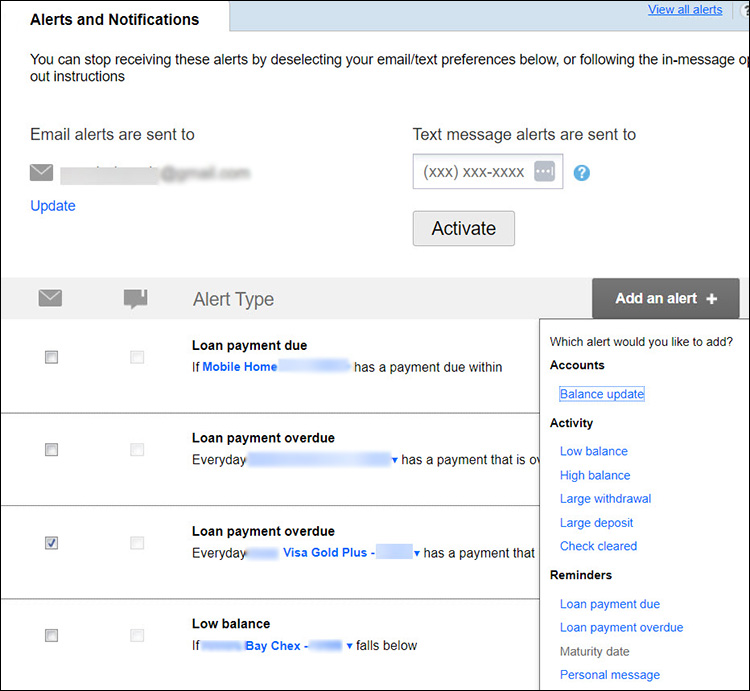

Set up Alerts in BayFed Online

- To set up this service, you will need to access the Text Banking & Alerts under the Additional Services tab. Then select the Add an Alert button.

- You may customize how you would like messages sent to you and how frequently the alert will show up.

Please note you may incur additional charges from your cellular carrier for the use of text messaging and/or data charges. If you have an Apple device, you may also set your alerts to arrive as push notifications.

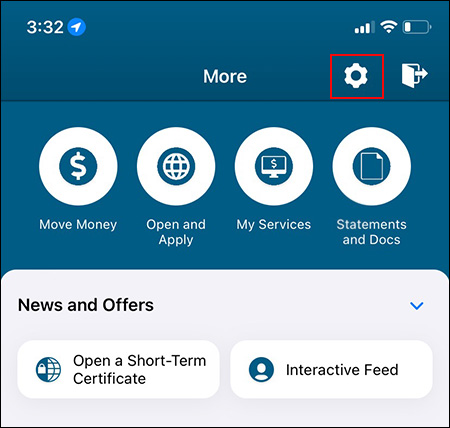

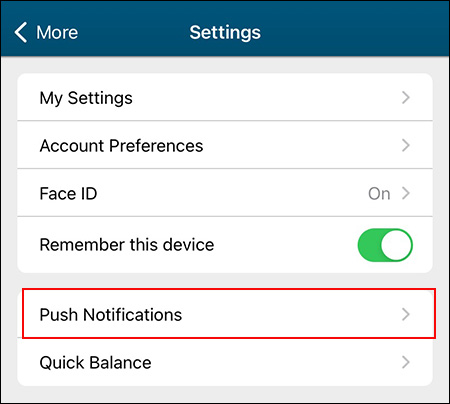

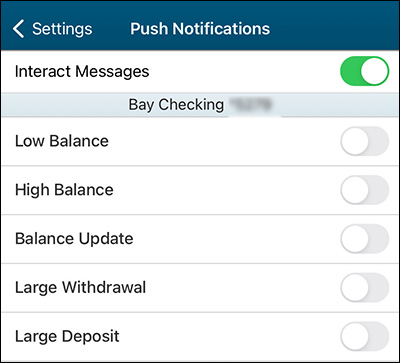

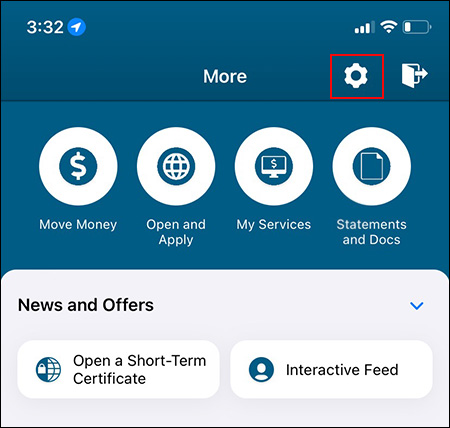

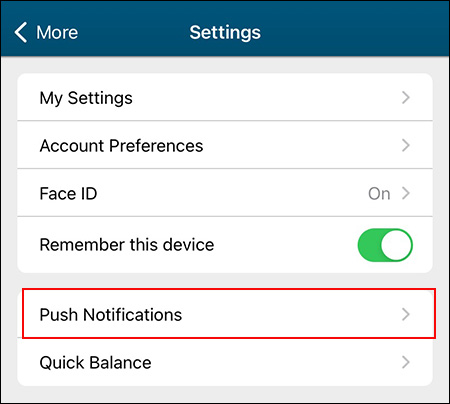

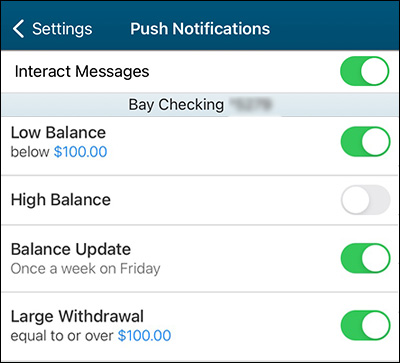

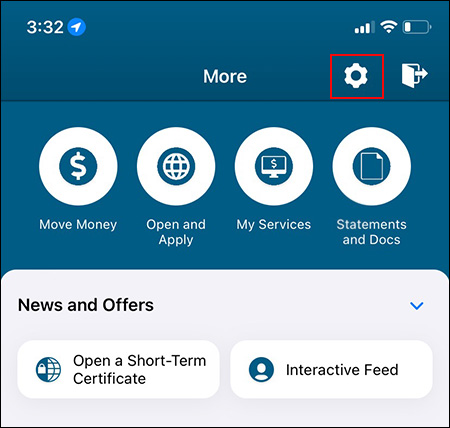

Set up Alerts in the BayFed Mobile app

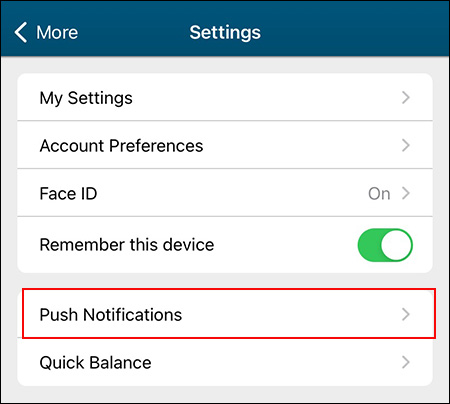

- Log in to the BayFed Mobile app and choose the More menu, then Settings, then choose Push Notifications.

- Choose from list of options under the account that you want to receive a notification. This includes account balance and activity notifications such as Low Balance and Large Withdrawal notifications. Use the switch to turn notifications on or off.

- To change the notification options, tap the notification line and change the amount or frequency of the notifications.

You may easily add, delete, or modify your alerts. Simply log into BayFedOnline or the BayFed Mobile app.

Update Alerts in BayFed Online

- Click on the Notifications tab on the upper right hand side of the page to manage your alerts.

- Select Settings to modify the alerts.

- Click on More Options to customize how you would like messages sent to you, the frequently the alert will show up, and the dollar amount that will trigger the alert.

UpdateAlerts in the BayFed Mobile app

- Log in to the BayFed Mobile app and choose the More menu, then Settings, then choose Push Notifications.

- To change the notification options, tap the notification line and change the amount or frequency of the notifications.

You can setup deposit alerts in BayFedOnline and the BayFed Mobile app.

Deposit Alert in BayFedOnline

- Log in to BayFedOnline, click Notifications in the top right corner, Setting and then click Add New Notifications. Here, you may schedule alerts for deposits based on the dollar threshold you choose.

Deposit Alert in the BayFed Mobile app

- Log in to the BayFed Mobile app and choose the More menu, then Settings, then choose Push Notifications. Use the switch to turn deposit notifications on or off. To change the notification options, tap the notification line and change the amount or frequency of the notifications.

Bay Federal Credit Union has convenient loan payment reminders that send you an email, text message, or mobile device notification before a payment is due. You can set how many days before the due date you'd like to receive the notification. Loan past due reminders can also be set up.

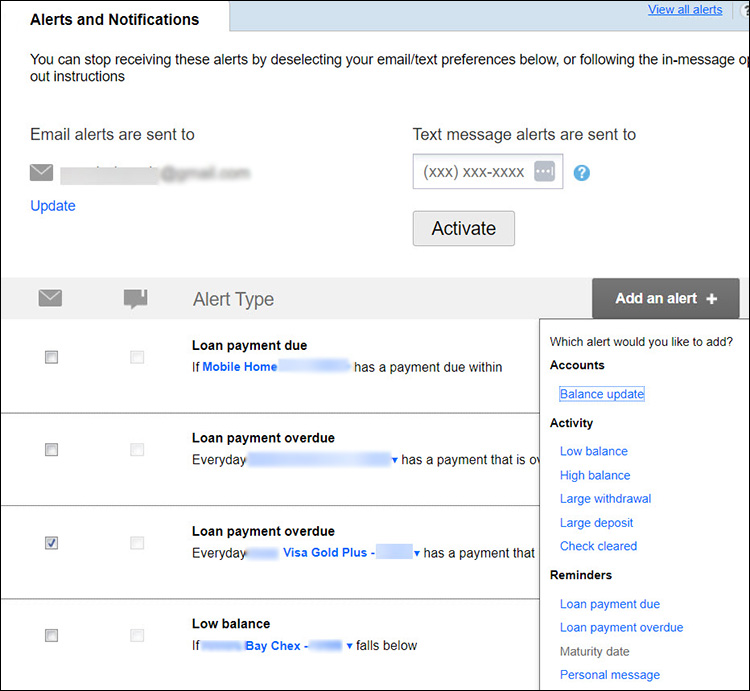

For Loan Payment Or Overdue Reminders By Email Or Text Messages

- Log in to online banking and choose Notifications from from the top right corner options. Then choose Settings from bottom of the pop-up panel.

- You will see a listings of alert types and delivery methods.

- Choose the Add an alert button and select the Loan Payment Due or Loan payment overdue reminders.

- Choose the loan account name to select which loan to send reminders for. To add reminders for multiple loans, use the Add an alert button again, then select the loan account name to add a different loan.

- Check the box in the email or text message column on the left to turn that delivery method on for the reminder. You can also uncheck a box to turn off that delivery method. Uncheck all boxes to turn off that reminder completely.

- To change when you receive a payment reminder, enter how many days before the due date it should be sent in the box on the right.

- Overdue reminders are sent daily while the loan is overdue.

- You can update the email address or mobile phone number that alerts are sent to using the update options at the top of the alerts list.

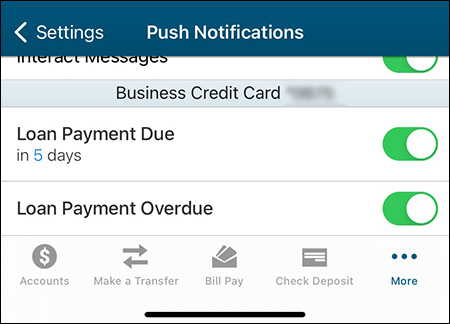

For Loan Payment Or Overdue Reminders On Your Mobile Device

- Log in to the BayFed Mobile app and choose the More menu, then Settings, then choose Push Notifications.

- Find the Loan Payment Due option under the loan account that you want reminder for. Use the switch to turn payment reminder on or off.

- To change when you receive a payment reminder, tap the reminder line and enter how many days before the due date it should be sent.

- Use the Loan Payment Overdue switch to turn overdue reminders on or off. Overdue reminders are sent daily while the loan is overdue.

Money Management FAQ

Add accounts from other institutions so you can view your whole financial picture in one place. Nearly any financial account can be linked! Checking and savings accounts, investments, credit cards, loans, mortgages and other lines of credit can all be added. You can also easily track Cash or Property values by adding manual accounts.

Transactions will be automatically cleansed for readability, and categorized to make it easy to see where your money is going. However, not all transactions can be automatically categorized, so it’s important to review your transactions regularly. For example, checks and ATM withdrawals will be left “Uncategorized,”and you will be prompted to assign a category for such transactions. Make any changes necessary to ensure your spending data is complete and accurate.

It can be helpful to review your Spending chart after reviewing your Transactions. You will better understand how your transaction categories influence your financial reports, and can often reveal spending details that need to be recategorized.

A budget makes it easy to visualize how much you’ve spent and how much money you have left for the month. Select “Auto Generate Budget” to let Money Management calculate your average monthly spending in each category for the last two months with complete data. This gives you a realistic starting point for your budget.

If you have a problem or question about Money Management, we encourage you to contact our support team. Feedback can be submitted through this channel as well.

To submit a support request:

- Click on the Help icon.

- Click on “Submit a Support Request” at the top right.

- Provide a detailed description of your question, problem, or another request.

- Submit.

Upon submitting your request, you will receive an email verifying receipt of your ticket. An agent will respond to you via email within one business day. If you have not seen the response within one business day, check your junk or spam folder.